Leipzig at a glance

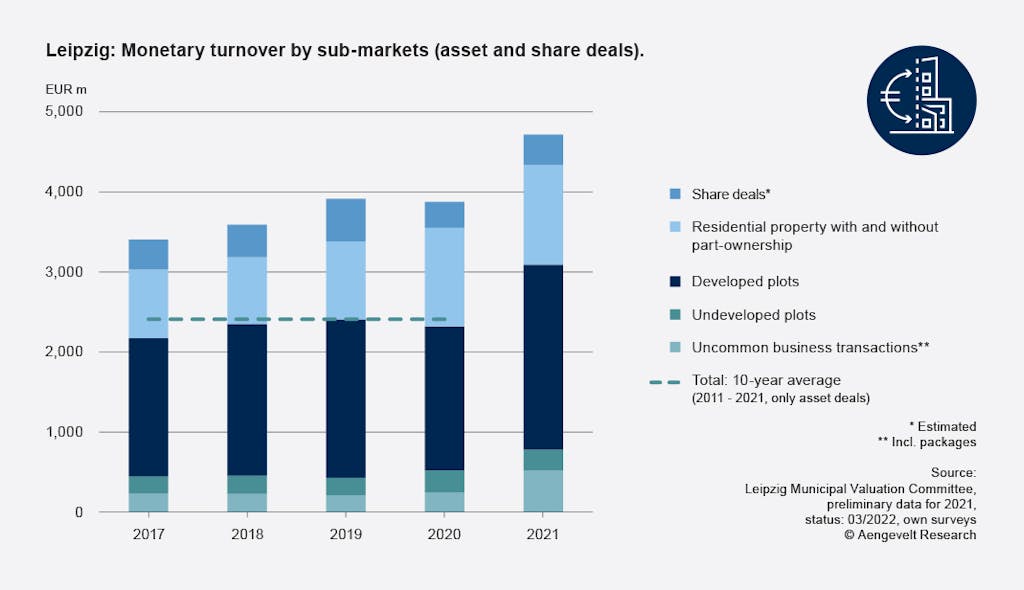

Leipzig: Cash turnover by submarket (asset & share deals).

In 2022, the market for developed land recorded the lowest turnover since 2014. The conventional transaction volume (asset deals) fell by 26.8% compared with the record result from the previous year (2021: EUR 2.31 billion), closing at EUR 1.69 billion within the year.

Cash turnover for building land amounted to around EUR 149.5 million in 2022, clearly missing the previous year's result by around 43% (2021: EUR 261.9 million). The average value for the most recent decade was undercut by 16%. Sales of undeveloped commercial space (asset, pure commercial) amounted to around EUR 19.1 million in the reporting year, 13.4% below the decade average (average 2012 - 2021: EUR 22.1 million).

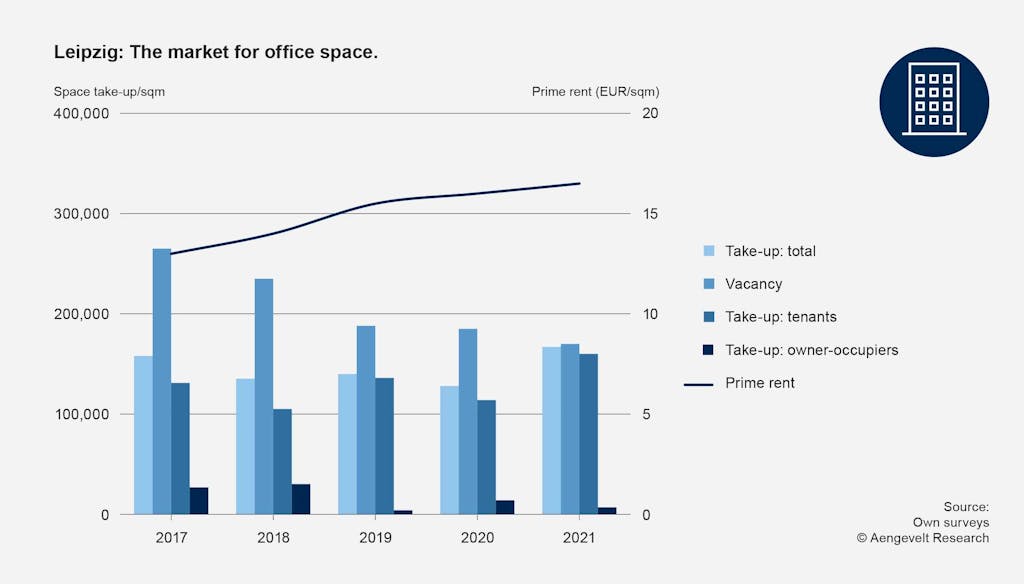

Leipzig: The market for office space.

After the office market regained its former strength in 2021 following a slump in 2020 during the Corona pandemic, new challenges awaited in 2022: War in Ukraine, energy crisis, shortage of resources, interest rate and price increases jeopardized sales. With office take-up of around 130,000 m² in 2022, clear trends of increasing momentum at pre-Corona levels could be observed in the Leipzig office market. To this end, the most recent ten-year average was also significantly exceeded with an increase of 11.5% (Ø 2012 - 2021: 116,600 m²).

The lack of demand-driven space in central Leipzig resulted in the weighted prime rent rising to EUR 17.50/m². The shortage in central locations within the city center "ring" is benefiting the city's other office locations, which is also accompanied by an increase in average rents here. Irrespective of this, the general level of rents continues to be friendly to new business, so that in terms of office costs the success story of the "young" and growing city of Leipzig can continue.

Thanks to continuous absorption of space in the face of insufficient supply, the vacancy rate has fallen again from a nominal 170,000 m² at the end of 2021 (4.4%) to just 158,000 m² (4.1%) at the end of 2022.

Leipzig: Monetary turnover on the residential real estate market (asset deals).

In 2022, the volume of transactions involving residential real estate (undeveloped, developed, residential and part-ownership) on the Leipzig property market was down by around 30.5% year-on-year to EUR 1.61 billion (2021: EUR 2.31 billion). With the exception of detached and semi-detached houses, which recorded an increase of around 6.0% (2022: EUR 175 million), all segments of the residential real estate market suffered losses. The most significant declines were seen in the trade in building land for individual residential construction (- 46.9% or EUR 17 million y-o-y in 2021) and the segment for rental apartment buildings (- 42.5% or EUR 330 million y-o-y in 2021).

The median property price for multi-family houses was now EUR 2.05 million, down 22.5% on the previous year. For detached and semi-detached houses, the average price was EUR 467,000, up 9.1% on the previous year (2021: EUR 428,000). Residential and part-ownership properties rose by 13.3% within the year, reaching a median value of EUR 257,000 per sale.

The dynamic population growth of the recent past and the associated increase in the number of households have contributed to an increase in land prices, rents and purchase prices as a result of the insufficient supply of housing. The average asking rents for existing apartments in the city as a whole are around EUR 8.00/m², while rents in the new-build segment average EUR 11.90/m². According to analyses by Aengevelt Research, this trend will continue in the coming years.

Ullrich Müller

Branch Manager Leipzig

-

Salomonstraße 21 Brockhaus-Zentrum | 04103 Leipzig

- +49 341 99776-47

- u.mueller@aengevelt.com