Frankfurt at a glance

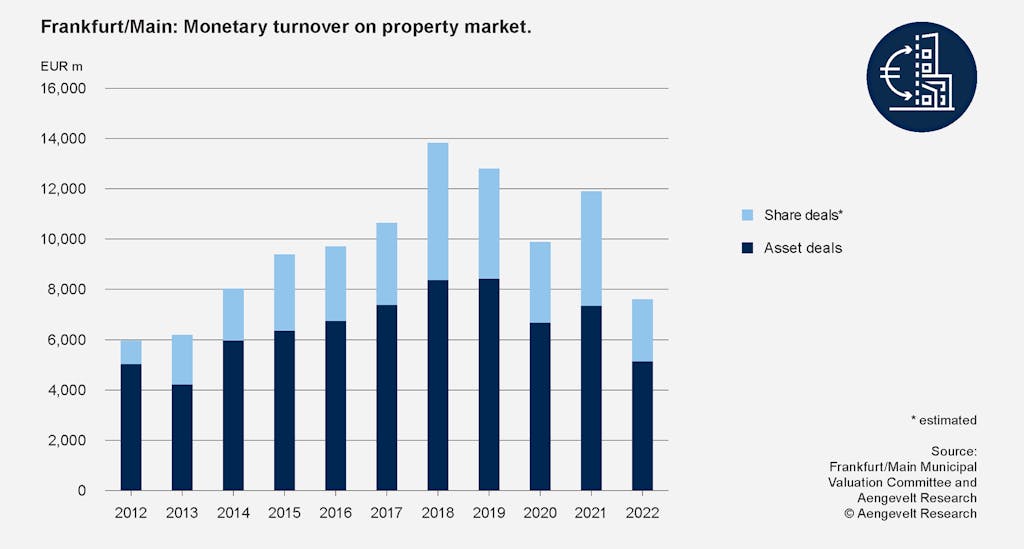

Frankfurt/Main: Money turnover in the real estate market.

With a transaction volume from conventional real estate sales (exclusively asset deals) of EUR 5.1 billion, not only was the previous year's result significantly undercut by 30% (2021: EUR 7.3 billion), but the ten-year average was also missed by around 23% (average 2012 - 2021: EUR 6.7 billion).

The market volume of traded office complexes halved compared with the previous year (around EUR 2.1 billion), with a result of around EUR 1.0 billion. As a result, traded office properties achieved a reduced share of turnover in the transaction volume of around 21% compared with previous years (2021: 28%; 2020: 28%). The condominium segment also performed weaker in the 2022 reporting year compared with previous years, in particular due to the rise in interest rates. With a transaction volume of around EUR 1.5 billion, the previous year's result was missed by a significant 26%.

The developed and undeveloped land submarkets also showed less momentum. Sales of undeveloped land amounted to around EUR 456 million. This corresponds to a decline of 61% within a year (2021: EUR 1.2 billion).

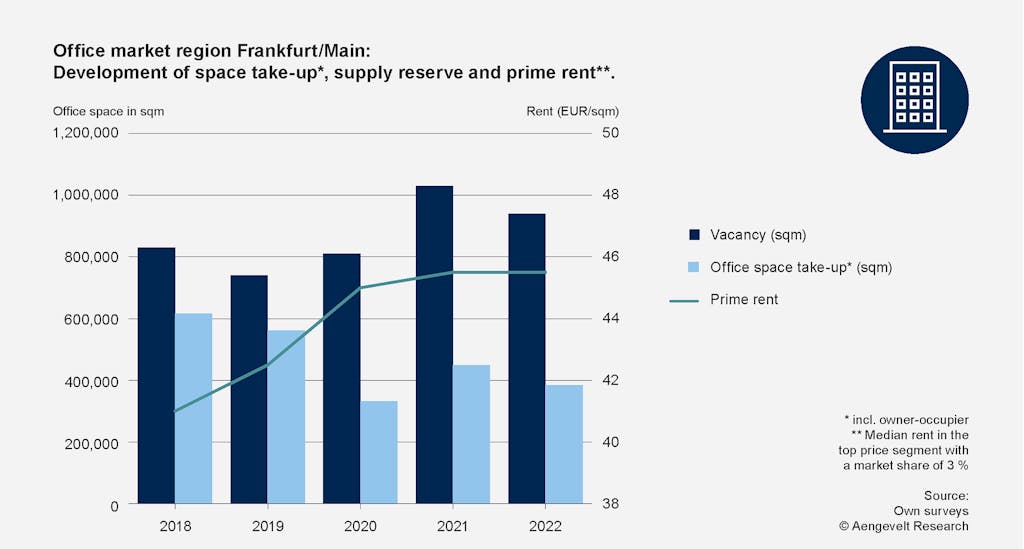

Office market region Frankfurt/Main: Development of space take-up, supply reserve and prime rent.

The year-end result of 384,300 sqm reflects the numerous challenges that shaped the office market in 2022. In particular, the cooled fourth quarter with a muted year-end rally impacted office take-up. Office take-up in 2022 reflects the vulnerability of the Frankfurt office market. Total take-up is around 22% below the decade average, and the previous year's result was also significantly undercut by around 14%. Nevertheless, the Main metropolis was able to maintain its position as the most expensive office location in Germany with a constant prime rent of EUR 45,50/sqm.

The total supply available in Frankfurt in the short term fell by around 90,000 sqm year-on-year to the current level of 940,000 sqm, a drop from 8.9% to 8.2%.

Completions decreased 37.5% year-over-year to 125,000 sq m in 2022, well below the recent long-term average. 56% of office completions in 2022 were in the Frankfurt city center, including the banking district, city center, Westend and main train station. Currently, around 630,000 sqm of office space is already under construction, of which "only" around 140,000 sqm is targeted for completion in 2023.

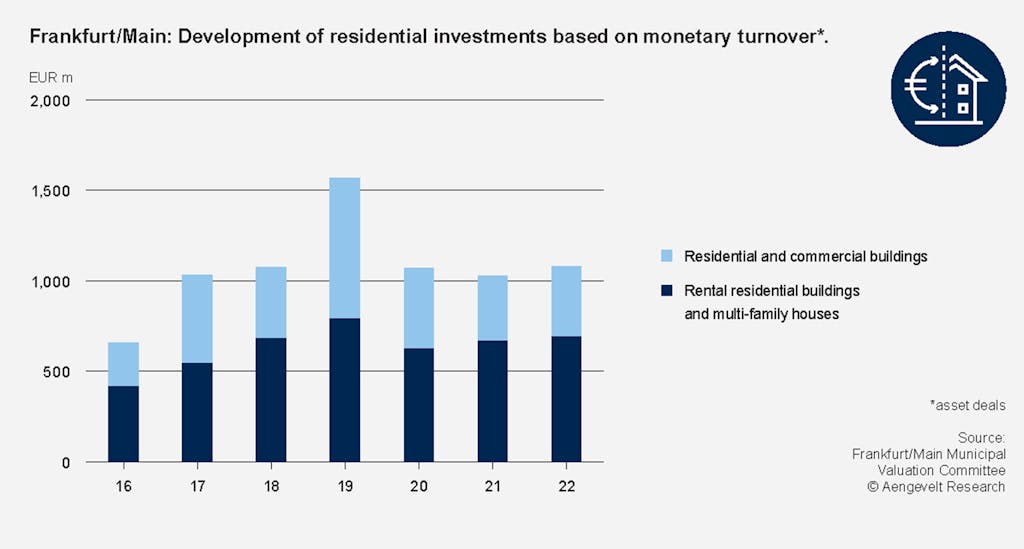

Frankfurt/Main: Development of residential investments based on monetary turnover 2021.

The sales volume of owner-occupied homes fell significantly in 2022 compared with the previous year: total cash sales amounted to around EUR 346 million, a drop of around EUR 141 million or 40% within the space of a year. Median purchase prices for owner-occupied homes fell by 9.1% year-on-year to around EUR 790,000.

In the detached single-family home segment, the amount of land sold fell by 23% from 5.2 ha (2021) to the current 4 ha. Cash turnover also decreased, by 22.5% from EUR 79.3 million to the current EUR 61.5 million.

With 3,093 condominium transactions and sales of EUR 1.45 billion, the number of purchase cases in 2022 fell by 11.8% year-on-year, while sales were down 25.9%. Over the course of the year, the average purchase price of the condominiums sold fell by 15.6% and now stands at around EUR 469,000 (2021: EUR 556,500).

In Frankfurt, asking rents for new apartments (60-80 sqm upscale) averaged EUR 16.90/sqm in the fourth quarter of 2022, up 4.7% year-on-year.

Frankfurt has the third-highest asking rents for new apartments among the Big Seven.

Daniel Milkus

Branch Manager Frankfurt

-

Große Gallusstraße 9 | 60311 Frankfurt/M.

- +49 69 92103-0

- d.milkus@aengevelt.com