Berlin at a glance

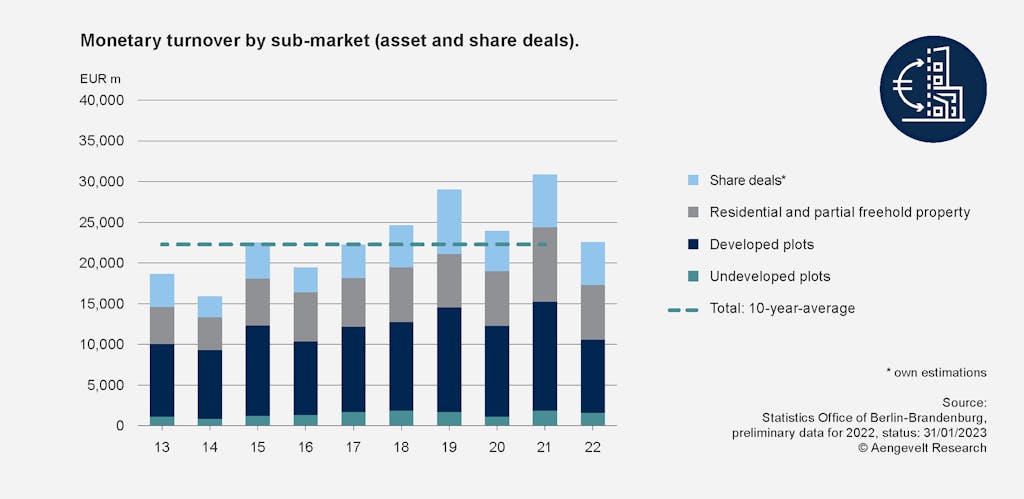

Berlin: Monetary turnover by sub-market (asset and share deals).

According to preliminary evaluations by the expert committee, a transaction volume of EUR 17.30 billion was contracted in Berlin in 2022 with the conventional trading of properties (asset deals). Thus - as correctly forecast by Aengevelt Research - the record mark from the previous year 2021 with a turnover of EUR 24.41 billion could not be reached. However, the latest annual result of only - 2.5% or around EUR 437 million was still within reach of the average value of the previous ten years (average 2012 - 2021: EUR 17.75 billion).

In addition to the asset deals, there is also a considerable share deal volume of around EUR 5.3 billion. The total transaction volume achieved in the Berlin real estate market in the reporting year 2022 thus amounts to around EUR 22.6 billion.

According to preliminary data from the expert committee, the number of asset deals concluded in 2022 was around 21,600, 24.2% below the previous year's figure of 28,500 conventional transactions.

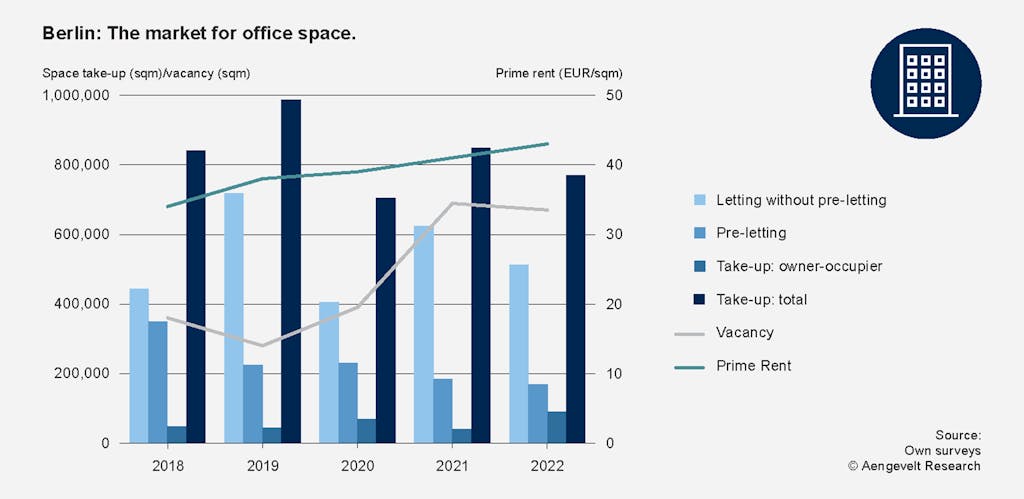

Berlin: The market for office space.

The economic uncertainty made itself felt on the Berlin office market, with take-up of around 770,000 sqm achieved in 2022. This was around 9% below the previous year's result (2021: 849,000 sqm) and just below the most recent ten-year average (Ø 2012 - 2021: 773,700 sqm p.a.) with a delta of minus around 0.5%.

Berlin thus remains the frontrunner in terms of take-up in Germany again in the 2022 reporting year, ahead of Munich (760,000 sqm) and Hamburg (551,000 sqm).

Contrary to the trend since 2020, the nominal supply reserve declined slightly in the year under review. In 2022, the citywide vacancy rate fell slightly to 3.2% (2021: 3.3%) and now stands at around 680,000 sqm of office space.

Of the completion pipeline planned up to 2026, around 1.5 million sqm is already under construction. The market is therefore expected to ease in the medium term as competition between providers remains lively.

The prime rent increased by around 5% year-on-year to EUR 43/sqm.

The average rent in city locations has also risen significantly to EUR 32 per square meter.

The trend on the outskirts of the city is also positive, with average rents rising to EUR 26. 50/sqm.

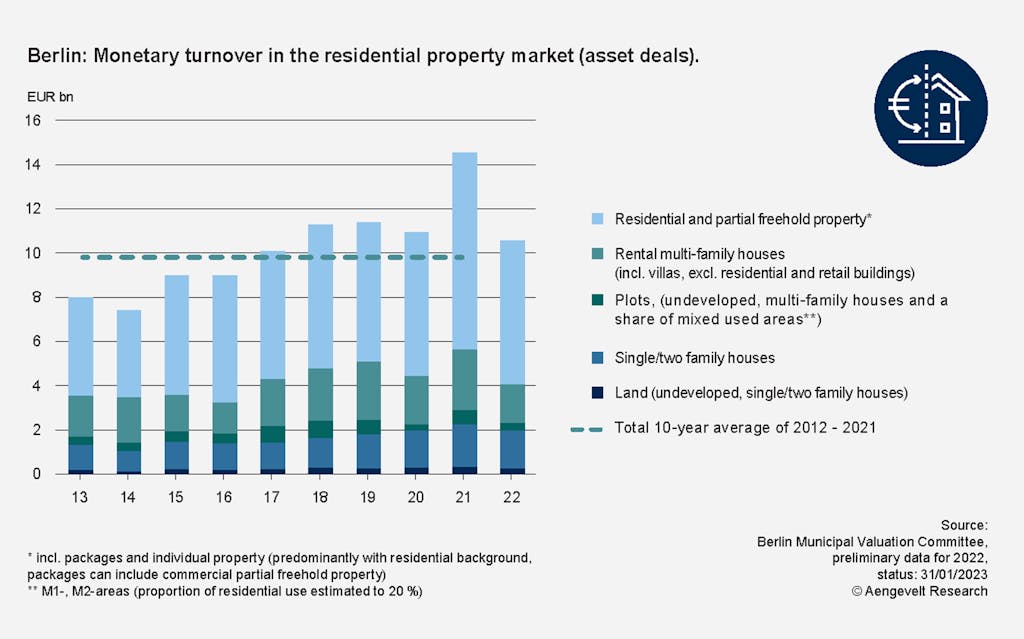

Berlin: Monetary turnover in the residential property market (asset deals).

The transaction volume from conventional sales (asset deals) of residential land, residential properties (excluding residential and commercial properties with more than 20% commercial share) and residential or part-ownership declined by 27.4% year-on-year to around EUR 10.5 billion in 2022 (2021: EUR 14.5 billion), according to preliminary analysis results from the Berlin Expert Committee.

According to preliminary evaluations by Aengevelt Research, around 16,400 permits for new apartments (new construction and changes to existing buildings, incl. apartments in non-residential buildings) were issued in Berlin in 2022, which corresponds to a decline of 12% compared with 2021 (18,700 permits). Contrary to the trend, permits for measures in the existing stock increased by around 8% year-on-year.

For 2022, Aengevelt Research still expects a solid completion volume of 16,300 apartments, as residential construction projects have already been started or are at a very advanced planning stage with secured financing. In the coming years, completion figures are at risk of declining significantly due to the economic and other complex challenges.

In 2022, the average rent in the new-build segment was around EUR 17. 50/sqm, which represents an increase of around 8.0% on the previous year. In the existing stock, the average across Berlin is around EUR 11. 70/sqm (+ 7.3%).

Top rents for new builds, mostly in particularly exclusive locations or properties, have risen by around 23.8% in the last five years to currently EUR 26/sqm. The minimum rent achieved is around EUR 10. 60/sqm.

In the existing portfolio, rents of between EUR 7. 40/sqm and EUR 20/sqm are being achieved for new leases, depending on the location and fittings.

Chiara Aengevelt

Managing Partner

-

Französische Straße 48 | 10117 Berlin

- +49 30 20193-254

- chiara@aengevelt.com